What are bonds?

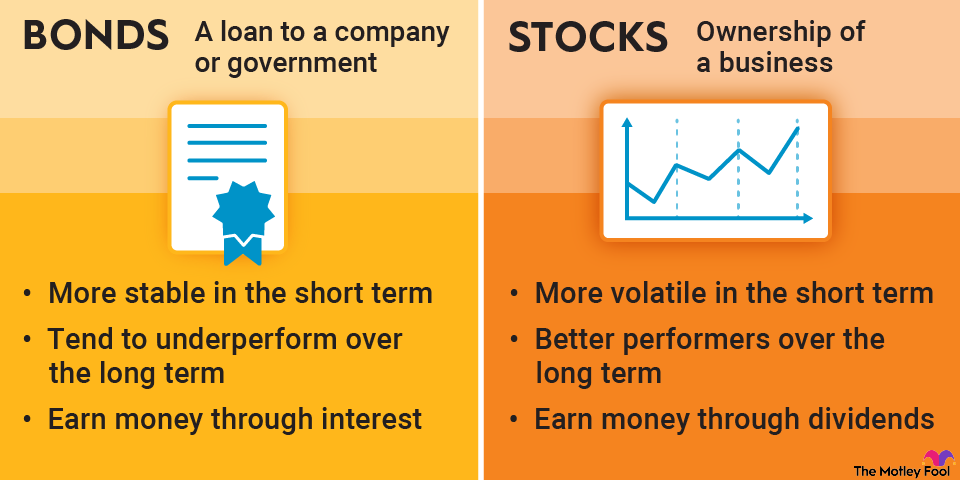

Bonds are debt securities issued by corporations and governments to raise capital. They are essentially loans that investors make to these entities, and in exchange, the issuer agrees to pay the investor periodic interest payments (known as coupons) and to repay the principal (the face value of the bond) when the bond matures.

The benefits of investing in bonds

There are a number of reasons why bonds can be attractive investments. First, they tend to be much less volatile than stocks, which means that they provide a steadier stream of income. This can be especially appealing to investors who are retired or nearing retirement and are looking for ways to generate a reliable source of income.

Another benefit of bonds is that they offer diversification. When you invest in bonds, you are effectively lending money to a corporation or government, which means that your investment is not directly tied to the stock market. This can help to protect your portfolio from sudden drops in stock prices, as bonds tend to hold their value better in times of market turbulence.

Lastly, bonds tend to offer higher returns than cash equivalents such as savings accounts or CDs. This is because the interest payments on bonds are fixed, while the interest payments on cash equivalents typically fluctuate with changes in the underlying interest rate.

The risks of investing in bonds

While bonds offer many benefits, there are also some risks to consider before investing. The most significant risk is interest rate risk, which refers to the possibility that bond prices will decline if interest rates rise. This is because when rates go up, new bonds are issued with higher coupon rates, making existing bonds with lower rates less attractive to investors.

Another risk to consider is credit risk, which is the possibility that the issuer will not be able to make the interest payments or repay the principal when the bond matures. This is more of a concern with corporate bonds than government bonds, as corporations are more likely to default on their debt obligations than governments.

How to invest in bonds

The best way to invest in bonds is through a bond mutual fund or ETF. These funds invest in a variety of different types of bonds, which helps to mitigate some of the risks associated with investing in individual bonds. For example, if you invest in a bond fund that holds both government and corporate bonds, you will be diversified across both credit risk and interest rate risk.

The different types of bonds

There are two main types of bonds: government bonds and corporate bonds. Government bonds are issued by national governments and are backed by the full faith and credit of the issuing government. This means that there is very little credit risk involved with investing in government bonds. Corporate bonds are issued by companies and carry a higher degree of credit risk since there is no guarantee that the issuer will be able to make all of the required interest payments or repay the principal when the bond matures.

Conclusion

Bonds can be an attractive investment for many reasons, but it’s important to be aware of the risks involved before investing. The best way to invest in bonds is through a bond mutual fund or ETF.