If you’re looking for a comprehensive guide to Zerodha, look no further! In this article, we’ll cover everything you need to know about this online broker, from its fees and features to its pros and cons.

What is the process of opening a Zerodha account

If you are looking to start investing in the stock market, one of the first things you need to do is open a Zerodha account. Here is a step-by-step guide on how to do that:

1. Go to the Zerodha website and click on the ‘Open an account’ button.

2. Fill out the online form with your personal details like name, email address, mobile number, etc.

3. Once you have completed the form, submit it and wait for a representative from Zerodha to get in touch with you.

4. They will then send you a link to complete your KYC (Know Your Customer) process.

5. Once your KYC is done, you will need to fund your account with an initial deposit. This can be done via net banking or UPI transfer.

6. Once your account is funded, you can start trading!

What are the requirements for opening a Zerodha account

Zerodha is a discount broker that allows you to trade in Indian markets at Zerodha charges. To open a Zerodha account, you need to have the following:

1. A PAN (Permanent Account Number) card issued by the Income Tax Department of India.

2. An Indian bank account that can be used to make online payments.

3. A valid email address and mobile phone number.

4. Your identity proof (such as a passport or Aadhaar card) and address proof (such as a utility bill).

What are the benefits of opening a Zerodha account

Zerodha is an online stockbroker based in India that offers brokerage-free equity investments and flat-fee trading. This means that Zerodha does not charge any commission on the buy or sell side of a trade, making it an attractive option for investors. In addition, Zerodha offers a flat-fee structure for all trades, regardless of volume or value. This makes Zerodha an ideal platform for small investors who want to trade without incurring high fees.

Some of the other benefits of opening a Zerodha account include:

– Access to a wide range of investment options: Zerodha gives investors access to a wide range of investment options, including stocks, mutual funds, ETFs, and more.

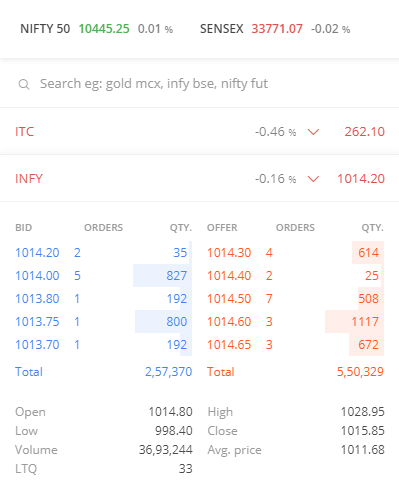

– Advanced trading tools: Zerodha provides its users with advanced trading tools and features, such as real-time market data, charts and analysis, and more.

– Convenient and user-friendly platform: The Zerodha platform is designed to be user-friendly and convenient for all investors. It is available in both English and Hindi, and can be accessed via the web or mobile app.

How can I open a Zerodha account

You can open a Zerodha account by following these steps:

1. Go to the Zerodha website and click on the ‘Open an account’ button.

2. Enter your personal details like name, email id, mobile number, etc.

3. Choose the type of account you want to open – Demat or Trading.

4. Select the desired trading plan and make the initial deposit.

5. Once all the formalities are completed, your Zerodha account will be opened.

Is Zerodha a good broker for beginners

Zerodha is a good broker for beginners because it offers a wide range of features and tools that can help them learn the ropes of online trading. For instance, Zerodha’s Pi trading platform is designed for use by both novice and experienced traders. The platform provides users with access to real-time market data, charts and analysis tools, and allows them to place orders directly from the charts. Zerodha also offers a demo account which can be used to test out the platform and familiarise oneself with the various features before committing to live trading. Furthermore, Zerodha’s customer support team is available to answer any queries that beginners may have.

What is the minimum amount required to open a Zerodha account

Zerodha is a discount brokerage firm in India that offers trading in stocks, commodities, currency pairs, and more. The minimum amount required to open a Zerodha account is Rs. 200. This account gives you access to Zerodha’s online trading platform and research tools.

What are the charges associated with opening and maintaining a Zerodha account

Zerodha is a discount broker that offers investors the ability to trade in Indian markets at Zerodha charges. The company was founded in 2010 and has since grown to become one of the largest brokers in India with over 1 million clients.

Zerodha account opening charges are Rs 300 + GST for equity, commodity, and currency derivatives. For mutual funds, there is no account opening charge but AMC (Annual Maintenance Charges) of Rs 20 per year per fund house.

For equity, Zerodha charges a flat rate of Rs 20 or 0.03% (whichever is lower) per executed order. For commodities and currency derivatives, the charges are 0.03% of the total contract value. Zerodha does not charge any brokerage for mutual funds.

There is also a monthly account maintenance fee of Rs 100 + GST which is waived off if you trade in a particular month. Lastly, there is a transaction charge of 0.0001% for all buy transactions and 0.0002% for all sell transactions.

Overall, Zerodha charges are very competitive when compared to other brokers in the market. This, combined with their excellent customer service, makes them one of the best brokers for retail investors in India.

How is Zerodha different from other brokers

Zerodha is a new age brokerage firm that prides itself on being different from the traditional brokerage firms. For starters, Zerodha does not have any physical branches. It is completely web based and can be accessed from anywhere in the world. This makes it very convenient for investors who are always on the go. Zerodha also has very low brokerages as compared to other firms. For instance, Zerodha charges Rs 20 per trade while a traditional firm would charge anywhere between Rs 200 to Rs 300 per trade. This makes Zerodha extremely affordable for small investors. Another key difference is that Zerodha offers a unique product called equity delivery which allows investors to buy and sell shares without having to pay any brokerage. This is a very popular product among first time investors.

Why should I open a Zerodha account

There are many reasons to open a Zerodha account. Zerodha is a Discount Brokerage firm which means it provides trading and investment services at a lower cost than traditional brokerages. It also offers a variety of unique features and tools that can save you time and money.

Zerodha is known for its customer service, and its team is available 24/7 to help you with any questions or concerns you may have. Zerodha also offers a mobile app so you can trade on the go.

Opening a Zerodha account is quick and easy, and you can get started with as little as Rs. 200. So why not give it a try? You may be surprised at how much you can save.

What do I need to know before opening a Zerodha account

If you’re looking to open a Zerodha account, there are a few things you should know first. For starters, you need to be an Indian resident and have a PAN card. You’ll also need to provide some basic personal information and documents, like your identity proof and address proof. Once you’ve opened your account, you can begin trading in stocks, mutual funds, and other securities.