If you’re like most investors, you want to know whether a stock is a good buy. After all, who wants to overpay for a stock? Many people turn to stock intrinsic value calculators to help them make investment decisions. But what exactly is intrinsic value, and how do you calculate it?

What is a stock intrinsic value calculator

Investors often ask “what is a stock’s intrinsic value?” The answer to this question is not as simple as it may seem. Many factors go into determining the intrinsic value of a stock, and there is no one right or wrong answer.

However, there are tools available to help investors calculate the intrinsic value of a stock. These tools are commonly referred to as “stock intrinsic value calculators.”

There are many different stock intrinsic value calculators available online. Some are free to use, while others require a subscription. Which calculator you use is up to you, but it’s important to remember that no calculator can give you a perfect answer. They can only provide an estimate based on the information that you input.

When using a stock intrinsic value calculator, you’ll typically be asked to input information such as the current stock price, earnings per share, dividend yield, and projected growth rate. The calculator will then use this information to estimate the intrinsic value of the stock.

It’s important to keep in mind that the intrinsic value of a stock is just an estimate. It’s not set in stone, and it can change over time. This is why it’s important to regularly review your investments and make sure that they’re still in line with your goals and risk tolerance.

If you’re looking for a stock intrinsic value calculator, there are many options available online. Do some research and find one that meets your needs and fits your budget.

How does a stock intrinsic value calculator work

A stock intrinsic value calculator is a tool that investors can use to estimate the true value of a stock. This value is not always the same as the current market price, and it can be difficult to calculate. However, using a calculator can help you to more accurately estimate the intrinsic value of a stock and make better investment decisions.

The intrinsic value of a stock is the real value of the company based on its fundamentals. This value can be different from the current market price, which is often driven by speculation and emotion. Intrinsic value is important because it represents the true worth of a company and its future potential.

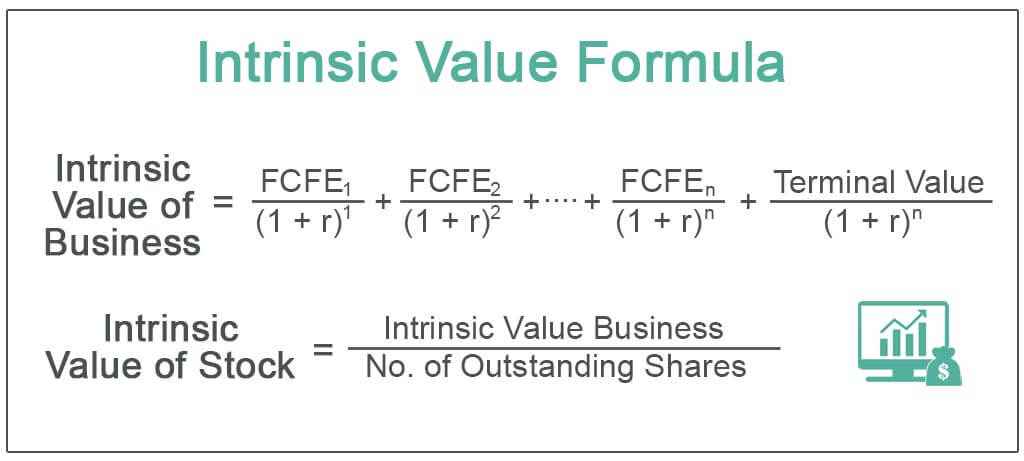

There are many factors that go into calculating the intrinsic value of a stock. The most important factor is the earnings per share (EPS). This tells you how much profit the company is making for each share of stock. Other important factors include the company’s dividend history, its balance sheet, and its growth prospects.

It can be difficult to calculate the intrinsic value of a stock yourself, but there are many online calculators that can do it for you. All you need to do is input the relevant information about the company and the calculator will give you an estimate of its intrinsic value.

Using a stock intrinsic value calculator can help you to make better investment decisions. It can also help you to avoid overpaying for a stock that may be overvalued by the market.

What factors does a stock intrinsic value calculator consider

When valuing a stock, analysts will often use something called an intrinsic value calculator. This calculator considers a number of factors in order to come up with a fair value for the stock. Some of the things that it takes into account include:

-The current earnings of the company

-The growth potential of the company

-The amount of debt that the company has

-The current market value of the company’s assets

All of these factors are then put into a formula which spits out a number that represents the intrinsic value of the stock. This number can be compared to the current market price of the stock to see if it is undervalued or overvalued.

What is the difference between a stock intrinsic value calculator and other valuation methods

A stock intrinsic value calculator is a tool that estimates the true worth of a stock, based on its underlying fundamentals. Other valuation methods, such as price-to-earnings (P/E ratios) or market capitalization, focus on more superficial factors and can produce misleading results.

How accurate is a stock intrinsic value calculator

An intrinsic value calculator is a tool that investors use to estimate the true value of a stock before buying or selling it. This value is based on a number of factors, including the company’s financial statement, current market conditions, and expected future performance. While there is no guarantee that the intrinsic value calculated by the tool will be accurate, it is a useful tool for investors to use in order to make informed decisions about their investments.

Is there a preferred stock intrinsic value calculator

Yes, there is a preferred stock intrinsic value calculator. This calculator can help you calculate the intrinsic value of your preferred stock. The intrinsic value is the true underlying value of a security. It is important to remember that the market price of a security may not always reflect its true underlying value. This is why it is important to use a calculator to determine the intrinsic value of your preferred stock.

How do I find a stock intrinsic value calculator

There are many ways to find a stock intrinsic value calculator. The most common way is to search for one online. There are many websites that offer this service, so it should not be difficult to find a reputable one.

Another way to find a stock intrinsic value calculator is to ask your broker or financial advisor for a recommendation. They may know of a good website or software program that you can use.

Once you have found a calculator, you will need to input some information about the stock you are interested in buying. This includes the current price of the stock, the dividend yield, and the expected earnings per share. With this information, the calculator will estimate the intrinsic value of the stock.

It is important to remember that the intrinsic value is only an estimate. It is not guaranteed to be accurate. However, it can give you a good idea of whether or not a stock is undervalued or overvalued.

If you are considering buying a stock, it is always a good idea to do your own research. This includes looking at the financial statements of the company and reading analyst reports. Ultimately, you should make your own decision about whether or not to buy the stock.

How do I use a stock intrinsic value calculator

To find a stock’s intrinsic value, you’ll need to use a stock intrinsic value calculator. This type of calculator uses several different inputs to come up with a fair value for a stock. Some of the inputs you’ll need to provide include the stock’s current market price, earnings per share, dividend per share, and the company’s growth rate.

Once you have all of the necessary inputs, you can plug them into the calculator and it will output the intrinsic value of the stock. From there, you can compare the intrinsic value to the current market price to see if the stock is undervalued or overvalued. If the intrinsic value is higher than the market price, then the stock is undervalued and may be a good investment.

What are some limitations of a stock intrinsic value calculator

There are several limitations to using a stock intrinsic value calculator:

1. The calculator does not take into account the effects of inflation.

2. The calculator does not consider the time value of money.

3. The calculator does not take into account the effects of taxes.

4. The calculator does not take into account the risk associated with investing in stocks.

5. The calculator does not take into account the costs of buying and selling stocks.

Are there any alternatives to a stock intrinsic value calculator

There are many stock intrinsic value calculators available online. However, there are a few alternatives that can be used to estimate the value of a stock. These include using a discount rate, comparing the company to its peers, and looking at the company’s financial statements.