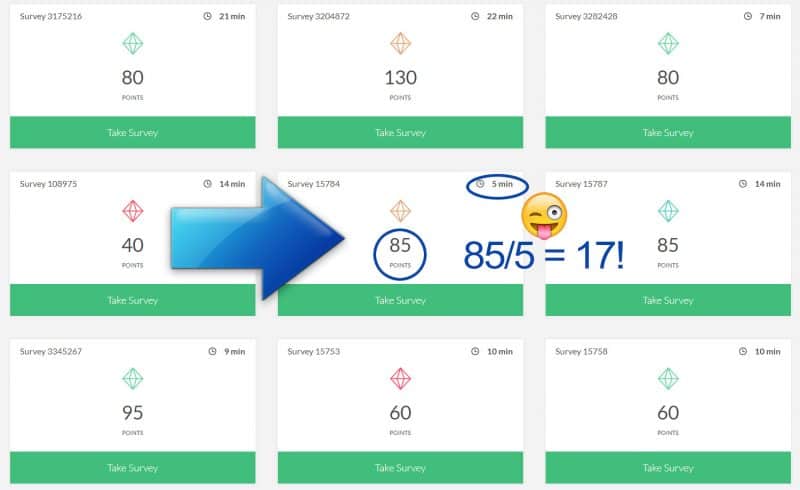

Best Stay at Home Dad Jobs [Ultimate List]

Dads, have you ever feel like you’re stuck in a rut? Stuck working the 9-5 job with no chance for advancement? Tired of feeling like you’re missing out on your kids’ lives? If you’re looking for a way to make a real difference in your family’s life, and have some fun while doing it, consider … Read more