If you’re looking to invest your money in a way that will earn you the most compound interest, then you’ve come to the right place. In this guide, we’ll go over some of the best options for compound interest investments, so you can make the most of your money.

What is Compound Interest?

Compound interest is the interest that accrues on an investment or loan over time. The initial investment or loan is called the principal, and the amount of interest earned is called the interest. The total amount of money earned from compound interest is the principal plus the interest.

Compound interest is different from simple interest, which is the interest earned on an investment or loan over a set period of time. With simple interest, the interest earned is not added to the principal, so the total amount of money earned is less than with compound interest.

Compound interest can be used to grow an investment or to pay down debt. When used to grow an investment, compound interest works like this: The investor starts with a sum of money, called the principal. The investor then earns interest on the principal, which is added to the principal. This new, larger principal then earns interest, which is added to the principal, and so on. Over time, the amount of money earned from compound interest grows exponentially.

When used to pay down debt, compound interest works like this: The borrower owes a sum of money, called the principal. The borrower then pays interest on the principal, which is added to the principal. This new, larger principal then accrues interest, which is added to the principal, and so on. Over time, the amount of money owed in compound interest grows exponentially.

Compound interest can work for or against an investor or borrower. It all depends on whether the rate of return on an investment is higher than the rate of interest charged on a loan.

What is Compound Interest Investing?

Compound interest investing is an investing strategy whereby investors reinvest their earnings back into their investment portfolio in order to earn greater returns over time. This reinvestment of earnings allows for the compounding of interest, which can help investors to grow their wealth more rapidly than if they simply left their earnings in cash.

Compound interest investing can be a great way to build wealth over time, but it does require patience and discipline. Investors who are able to stick with their reinvestment strategy for the long haul can be rewarded with significant returns.

There are a few things to keep in mind when it comes to compound interest investing. First, it’s important to invest in quality assets that have the potential to generate strong returns. Second, it’s important to reinvest your earnings back into your portfolio on a regular basis. And finally, you need to be patient and disciplined in order to see the best results.

If you’re able to follow these guidelines, then compound interest investing can be a great way to build your wealth over the long term.

Simple Interest vs Compound Interest

There are two main types of interest: simple interest and compound interest. Simple interest is calculated only on the principal, while compound interest is calculated on both the principal and any accumulated interest.

Both simple and compound interest can be used to grow your savings, but compound interest has the potential to grow your money faster because it compounds, or reinvested, periodically.

Here’s a closer look at the key differences between these two types of interest:

Simple Interest

Simple interest is calculated as a percentage of the principal only. In other words, if you have $1,000 in a savings account that pays 5% simple interest per year, you’ll earn $50 in interest each year. That money is then added to your principal balance, so the next year you’ll earn interest on $1,050.

Compound Interest

Compound interest is calculated as a percentage of the principal and any accumulated interest. So, using the same example above, if you have $1,000 in a savings account that pays 5% compound interest per year, you’ll earn $50 in interest the first year. That $50 is then added to your principal balance, so the second year you’ll earn interest on $1,050.

The key difference between simple and compound interest is that compound interest is reinvested periodically, which allows your money to grow at a faster rate. With simple interest, you only earn interest on your original investment (the principal). But with compound interest, you earn interest on both your original investment (the principal) and any accumulated interest.

How to Manage Your Investment Portfolio for Good Returns

No matter how much money you have to invest, it’s important to manage your investment portfolio carefully. That means understanding what types of investments are right for you and monitoring those investments over time to make sure they’re still performing well.

Here are some tips for managing your investment portfolio:

- Understand your investment goals.

Are you investing for retirement? For a child’s education? To generate income? Your investment goals will dictate the types of investments you make. For example, if you’re saving for retirement, you’ll want to focus on investments that offer growth potential, such as stocks and mutual funds.

- Consider your risk tolerance.

How much risk are you willing to take on? This is an important question to consider when making investment decisions. If you’re comfortable with more risk, you may be willing to invest in higher-growth (and potentially higher-risk) options like stocks. If you’re risk-averse, you may prefer to stick with more conservative investments, such as bonds or cash equivalents.

- Diversify your portfolio.

Don’t put all your eggs in one basket. When you diversify your portfolio, you spread out your risk by investing in a variety of assets. That way, if one investment loses value, the others may offset those losses. For example, you might diversify by investing in a mix of stocks, bonds, and cash equivalents.

- Review your portfolio regularly.

Investments can go up and down in value over time, so it’s important to monitor your portfolio on a regular basis. At least once per year, review your investments and make sure they’re still aligned with your goals and risk tolerance. Rebalancing may be necessary if your asset allocation has become too skewed in one direction or another.

By following these tips, you can help ensure that your investment portfolio is on track for meeting your long-term financial goals.

Top Compound Interest Investments to Grow Your Money

When it comes to investing your money, there are a lot of options to choose from. But if you’re looking for an investment that will really help you grow your money, you should consider investing in one of these top compound interest investments.

Compound interest is when you earn interest on your original investment, as well as on any interest that has accumulated over time. This can help you grow your money much faster than if you were simply earning interest on your original investment.

There are a few different types of investments that offer compound interest, and each has its own benefits and risks. Here are some of the best options to consider:

- Savings Accounts: A savings account is a great option if you’re looking for a safe place to grow your money. Most savings accounts offer compound interest, so you’ll earn interest on your balance as it grows. However, savings accounts typically have lower interest rates than other types of investments, so they might not be the best option if you’re looking to grow your money quickly.

- Certificates of Deposit: A certificate of deposit (CD) is another safe option for growing your money. With a CD, you agree to leave your money in the account for a set period of time, typically 1-5 years. In return, the bank offers a higher interest rate than what you would earn in a savings account. When the CD matures, you can withdraw your money plus any interest that has accumulated.

- Bonds: Bonds are debt instruments that are issued by corporations or governments. When you purchase a bond, you’re lending money to the issuer and agreeing to be repaid over a certain period of time, typically 10-30 years. Bonds typically offer higher interest rates than savings accounts or CDs, but they also carry more risk since there’s a chance the issuer will default on the loan.

- Real Estate Investment Trusts: A real estate investment trust (REIT) is a type of investment that allows you to invest in commercial real estate without actually owning any property. REITs are bought and sold on major stock exchanges, just like stocks and bonds. When you invest in a REIT, you’re essentially buying shares of a company that owns and manages income-producing real estate properties. REITs typically offer high dividend yields and can offer exposure to a variety of different property types, such as office buildings, shopping malls, warehouses, and apartments. However, REITs are subject to changes in the market and can lose value if the underlying properties decline in value.

- Mutual Funds: A mutual fund is an investment that pools together money from many different investors and invests it in a variety of securities, such as stocks, bonds, and other assets. Mutual funds are managed by professional money managers who attempt to generate returns for their investors by carefully selecting which securities to include in the fund. Mutual funds offer investors diversification and professional management, but they also come with fees and expenses that can eat into returns.

These are just a few of the different options available for growing your money through compound interest. Talk to a financial advisor to help you select the best option for your individual needs and goals.

How Much Money Can Compound Interest Make?

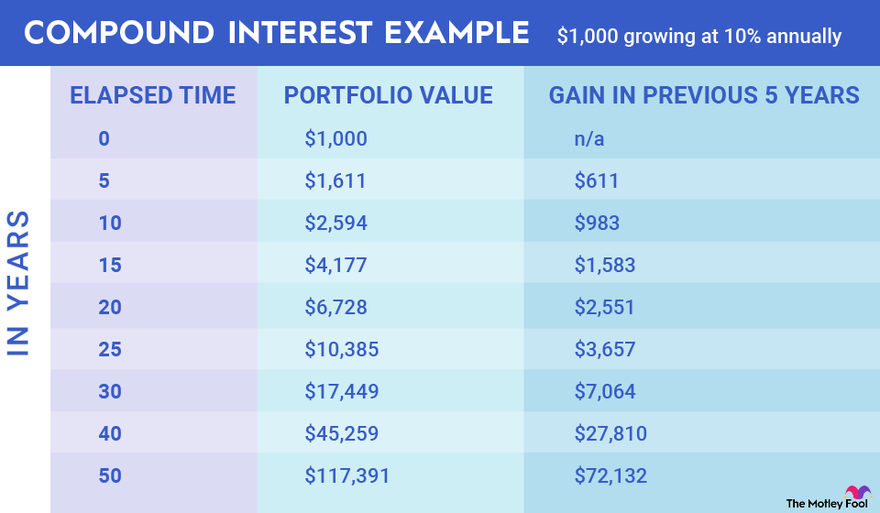

We all know that compound interest is the key to growing our money. But how much can it really make?

To answer that, we need to understand a few things about compounding:

- The more frequently interest is compounded, the faster your money will grow.

- The longer you leave your money in a compounding account, the more interest you will earn.

- The higher the interest rate, the faster your money will grow.

Assuming we make no withdrawals and leave our money in an account forever, here’s how much money compound interest can make:

If we start with $100 and earn 5% interest, compounded annually, we will have $110 after one year. After two years, we will have $121 – that’s $11 in interest earnings.

If we start with $100 and earn 5% interest, compounded monthly, we will have $105 after one year. After two years, we will have $110 – that’s $10 in interest earnings. So far, compounding monthly has only earned us an extra $1 compared to compounding annually. But wait…

If we start with $100 and earn 5% interest, compounded daily, we will have $105 after one year. After two years, we will have $115 – that’s $15 in interest earnings. Now we’re really starting to see the power of compounding!

As you can see, the more frequently interest is compounded, the more money you will earn in interest. And the longer you leave your money in a compounding account, the more interest you will earn.

So how much can compound interest really make? It all depends on the factors mentioned above. But if you give it enough time, compound interest can make a lot of money!

Can You Get Rich Off Compound Interest?

It’s no secret that compound interest is one of the most powerful forces in finance. By reinvesting your earnings and allowing them to grow, you can build a sizable nest egg over time. But can you actually get rich off compound interest?

The answer, of course, is yes – but it takes time, patience, and a bit of luck. While there’s no guarantee that you’ll become a millionaire through compound interest, it is possible to achieve financial independence if you start early and invest wisely.

Where Can I Put My Money to Earn the Most Interest?

When it comes to earning interest on your money, there are a few things to consider. First, you need to decide if you want to keep your money in a savings account or invest it. Second, you need to research the best interest rates for both options.

A savings account is a safe place to keep your money. Your principal (the amount of money you deposit) is guaranteed by the FDIC up to $250,000. The downside is that savings account interest rates are relatively low right now. The average savings account interest rate is only 0.09% APY.

Investing your money is riskier than keeping it in a savings account, but it has the potential to earn a higher return. When you invest, you’re essentially lending your money to a company or government in exchange for interest payments. The interest payments on bonds tend to be higher than the interest rates on savings accounts. For example, the current 10-year US Treasury yield is about 1.6%.

The best way to earn the most interest on your money depends on your goals and risk tolerance. If you want guaranteed safety, a savings account is the way to go. But if you’re willing to take on some risk for the chance of higher returns, investing in bonds may be the better option.

How to Calculate Compound Interest

Compound interest is the addition of interest to the principal sum of a loan or deposit, such that from that moment on, the interest that has been added also earns interest. This addition of interest to the principal is called compounding.

The simplest way to calculate compound interest is to use the following formula:

A = P(1 + r/n)^nt

where:

A = the future value of the investment/loan, including interest

P = the principal investment amount (the initial deposit or loan amount)

r = the annual interest rate (decimal)

n = the number of times that interest is compounded per year

t = the number of years the money is invested or borrowed for

For example, let’s say you invest $100 at 10% annual interest, and the interest is compounded monthly. In this case, r would be 0.10 (10% expressed as a decimal), and n would be 12 (the number of months in a year). The formula would then become:

A = 100(1 + 0.10/12)^(12*5)

A = 100(1.008333333)^60

A = 100(1.818989402)

A = $181.89

If you’re given an investment’s future value and are asked to calculate its present value, you can do so using this formula:

P = FV/(1 + r/n)^nt

where all the variables are defined as above except for FV, which represents the future value of the investment.

Accounts that Pay Compound Interest

We all know that it’s important to save our money. But what’s even more important is how we save our money. If you’re like most people, you probably have a savings account that pays you a little bit of interest each year. And while that’s better than nothing, there are much better ways to grow your money.

One of the best ways to grow your money is to invest in an account that pays compound interest. With compound interest, you not only earn interest on your original investment, but you also earn interest on the interest that has already been earned. This can add up to some serious cash over time.

There are a few different types of accounts that pay compound interest, but one of the best is a high-yield savings account. These accounts typically offer higher interest rates than traditional savings accounts, which means your money will grow at a faster rate.

If you’re looking for a high-yield savings account, there are a few things to keep in mind. First, make sure to shop around and compare rates from different banks. Second, be aware of any fees associated with the account. And finally, remember that the interest rate is important, but it’s not the only thing to consider – make sure the account is FDIC insured and offers other features that are important to you.

Once you find the right high-yield savings account for you, start saving as much money as you can into it. The sooner you start, the more time your money will have to grow. And before you know it, you could be well on your way to a healthy nest egg.

Why You Need Compound Interest Investments

If you’re like most people, you probably think that saving money is the key to building wealth. And while saving is important, it’s not enough on its own. You also need to invest your money so it can grow.

One of the best ways to grow your money is through compound interest. With compound interest, you earn interest not only on the money you save, but also on the interest that you’ve already earned. This can help your money grow much faster than if you were simply saving it.

Of course, there are other important factors to consider when growing your wealth, such as investing in a diversified portfolio of assets and actively managing your investments. But if you’re not taking advantage of compound interest, you’re missing out on one of the most powerful tools for building wealth.

Where to Invest for Compound Interest

Investing for compound interest is a strategy that can be used to grow your wealth over time. By reinvesting your earnings and allowing them to compound, you can potentially earn a lot more money than if you simply saved your money in a savings account.

There are a few different ways to invest for compound interest, but one of the most popular is to invest in stocks or mutual funds. When you invest in stocks or mutual funds, you are essentially buying a piece of a company that will be worth more in the future. As the company grows and becomes more profitable, the value of its stock will increase. This increase in value can provide you with capital gains, which are profits that you can then reinvest and allow to compound.

Another way to invest for compound interest is through real estate. When you invest in real estate, you are essentially buying a property that will appreciate over time. As the property increases in value, you will be able to sell it for a profit or use it as collateral for a loan. Either way, you will be able to reinvest your earnings and allow them to compound.

The best way to invest for compound interest is to start early and reinvest often. The sooner you start investing, the longer you will have for your investments to grow. Additionally, the more frequently you reinvest your earnings, the faster your money will grow. If you wait too long to start investing, or if you don’t reinvest your earnings, you may miss out on the opportunity to earn a significant amount of money through compound interest.

How Old Do You Have to Be to Invest in Compound Interest Accounts?

The answer to this question depends on a few factors, but the most important one is your age. If you’re younger than 18, you generally won’t be able to open a compound interest account on your own. However, there are some ways around this.

For instance, if you have a parent or guardian who is willing to help you open an account, they can do so with a few extra steps. In addition, some financial institutions offer special accounts for minors that come with some restrictions.

Another factor to consider is the type of compound interest account you’re interested in opening. For example, some banks require that you have a certain amount of money deposited before they’ll start paying interest. Others have minimum balance requirements that must be met in order to avoid fees.

Lastly, it’s important to remember that compound interest only really starts to add up after a period of time. This means that the sooner you start saving, the more money you’ll ultimately have. So, even if you can’t open an account on your own right now, it’s never too early to start planning for your future.