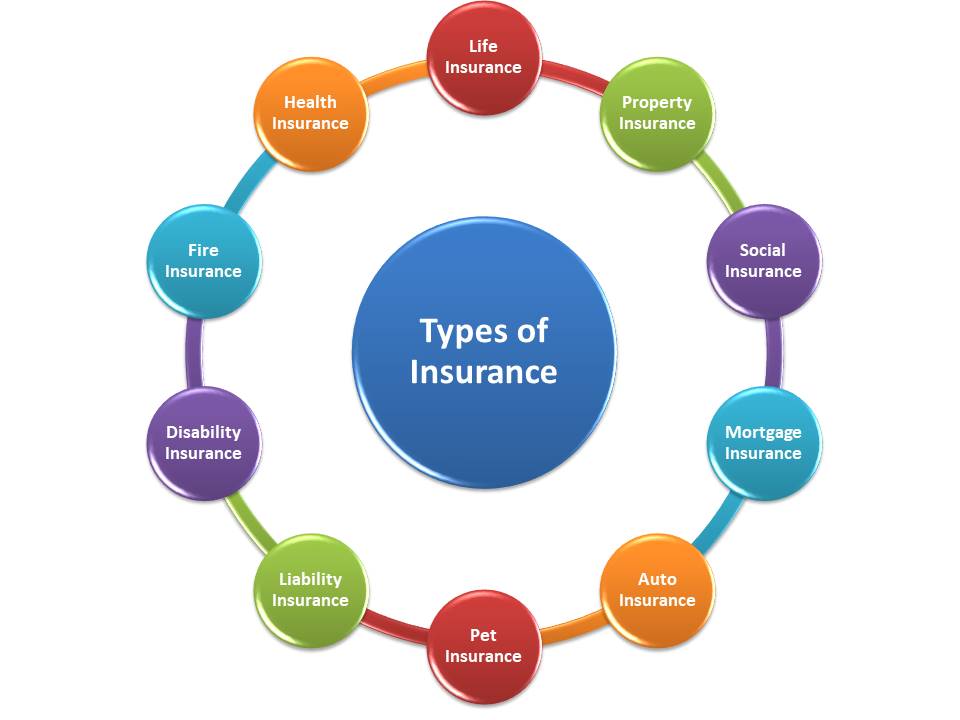

There are many types of insurance, and each one is designed to protect you from different risks. Some types of insurance are required by law, while others are optional. Here is a brief overview of the most common types of insurance:

- Health Insurance

Health insurance protects you from the financial costs of medical care. It can help you pay for doctor visits, hospital stays, prescription drugs, and other health care expenses. Most health insurance plans are offered through employers, but you can also purchase a plan on your own.

- Auto Insurance

Auto insurance protects you from financial losses resulting from car accidents. It can help pay for repairs to your vehicle, medical expenses, and legal fees. Most states require drivers to have auto insurance.

- Homeowners Insurance

Homeowners insurance protects you from financial losses resulting from damage to your home or possessions. It can help pay for repairs, replacement costs, and legal fees. Homeowners insurance is typically required by lenders if you have a mortgage.

- Life Insurance

Life insurance provides financial protection to your loved ones in the event of your death. It can help pay for funeral expenses, outstanding debts, and living expenses. There are many different types of life insurance policies available, so it’s important to choose one that meets your needs.

- Disability Insurance

Disability insurance provides financial protection if you become unable to work due to an injury or illness. It can help replace a portion of your lost income and cover expenses such as medical bills and rehabilitation costs.